F&A for Industry Clinical Trials Only - 36%

The University currently accepts an F&A rate of 36% applied to all direct costs (not modified total direct costs) for industry-supported clinical trials only.

Facilities and Administrative (F&A) Rates are the mechanism used to reimburse the University of Miami (University) for for costs covering common or joint objectives—such as infrastructure support, central services, office supplies, general use equipment, utilities, and other indirect costs—and therefore are not readily allocable to any specific project. F&A rates are essentially overhead rates, calculated as a percentage of the direct costs of sponsored projects. These are actual costs to the University and directly support sponsored projects being performed by the University. F&A rates are also referred to as indirect cost rates.

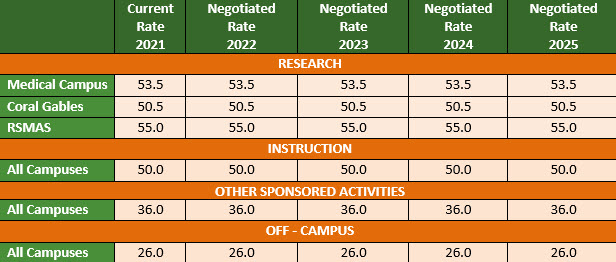

Our F & A Rate Agreement contains our negotiated rates, which are summarized below. You may also read the letter from our Cognizant Agency.

University personnel and offices that submit funding proposals must ensure such proposals utilize the appropriate approved F&A rate for the proposed activity, as detailed in the sections below and Appendix III to 2 CFR Part 200—Indirect (F&A) Costs Identification and Assignment, and Rate Determination for Institutions of Higher Education (IHEs). The F&A rate in effect at the time of budget submission must be appropriately applied to the direct cost budget. Sponsor agreements from non-U.S. governmental agencies, including pass-through agreements, and awards transferred to the University must apply the current approved F&A rate for the proposed activity. University will not accept a pass-through entity’s rate. Only under exceptional circumstances will requests for waivers of F&A cost recovery or the acceptance of a reduced F&A rate be approved—see below Waivers for Reduced F&A Section below.

Other sponsored activities mean programs and projects which involve the performance of work other than instruction, organized research, fellowships, clinical trials, or research training. Examples of such projects include transfers under Inter Personnel Agreements (IPAs), travel grants, symposia, seminars, and conferences, and community outreach and services.

The off-campus rate applies for all activities: a) performed in facilities not owned by the institution and where these facility costs are not included in the F&A pools; or b) where rent is directly allocated/charged to the project(s). Grants or contracts will not be subject to more than one F&A cost rate. If more than 50% of a project is performed off-campus, the off-campus rate applies to the entire project.

Working remotely (i.e.: from a home office) is not sufficient justification for using the off-campus rate. When a University employee has an approved remote work arrangement in accordance with University’s Remote Work Policy, their home office or remote work location becomes an extension of the University’s campus.

Work performed by subrecipients, vendors, or consultants should not be considered; only University’s activities should be reviewed when determining on-campus or off-campus rate eligibility.

The USDA typically imposes an indirect cost limitation of 30% of the Total Federal Funds Awarded (TFFA) to the recipient.

To calculate the TFFA, use the following TDC examples:

How does 30% of TFFA equate to 42.857% of TDC?

You can convert 30% of Total Federal Funds Awarded (TFFA) to Total Direct Costs (TDC) as follows:

The following policy pertains to F&A guidelines for research projects that include more than one school/campus. Policy: F&A Distribution Guidelines for Inter-school Research

The University currently accepts an F&A rate of 36% applied to all direct costs (not modified total direct costs) for industry-supported clinical trials only.

University will generally accept reduced F&A rates when the sponsor has a written, publicly available policy that limits or prohibits F&A cost recovery. University will accept official letters (on letterhead) from a sponsor’s high-ranking administrative officer stating their F&A policy in lieu of a publicly available rate policy. Letters will not supersede published rates. Waiver requests for a reduced F&A rate must be submitted in accordance with UM’s F&A Waivers Policy and approved at the time of proposal through the submission of a completed Request for a Waiver or Reduction of Facilities & Administrative (F&A) Costs & Cost Sharing Form.

University automatically waives F&A cost recovery for all non-governmental proposals with a total value of less than $5,000.

Copyright: 2026 University of Miami. All Rights Reserved.

Emergency Information

Privacy Statement & Legal Notices

Individuals with disabilities who experience any technology-based barriers accessing University websites can submit details to our online form.